Risk-Adjusted Portfolio Management

A majority of investors lack a disciplined approach to buying and selling equities. The success of a purchase and sale often depends on predictions of the future share price and market conditions in general. Despite all the analytical tools that Wall Street has at their disposal, over time their predictions may not be any better than the toss of a coin. Our risk adjusted portfolio strategies broaden the range of profit potential utilizing options. Calculated entry and exit points based upon supply and-demand dynamics help take emotion out of the equation.

By incorporating covered calls and puts into the mix, the Equity Risk Management Group offers investors:

- Reduced reliance on specific equity and market movements

- Increased likelihood of a greater rate of return versus traditional equity purchase

- Potential of positive returns even if the share price remains flat

- Opportunity to generate positive returns if the share price moves down within a certain range

- Defined parameters of downside risk and upside potential

The bottom line: we increase the probability that our clients will make money, while at the same time formulating strategies for reducing their risk.

“While most investors insure their life, health and home, they often neglect to protect their portfolios.”

Jason Weissman

Senior Director

* For more information about Risk-Adjusted Portfolio strategies, email us or call us at 212-320-2040 for a full discussion of how best to protect it.

* Please see Glossary for an explanation of certain terms contained herein.

* Supporting documentation for any claims in the Equity Risk Management Section will be supplied upon request.

By utilizing covered calls, investment returns are capped at the strike price of the contract plus the premium. While this may increase the total return, it may also reduce potential profits of the equity purchased as opposed to not having sold a covered call. Investor bears downside risk to protection levels less premiums collected.

The sale of puts, while generating additional premiums and partially reducing the cost basis of the equity, will, at times, increase your exposure to the underlying equity.

You should also be aware that there are additional fees and commissions associated with our program when spread transactions that require two legs are utilized.

Be aware that there are inherently greater risks associated when margin and/or other leverage is utilized that will substantially increase the potential of both gains and losses. Options are not suitable for all investors.

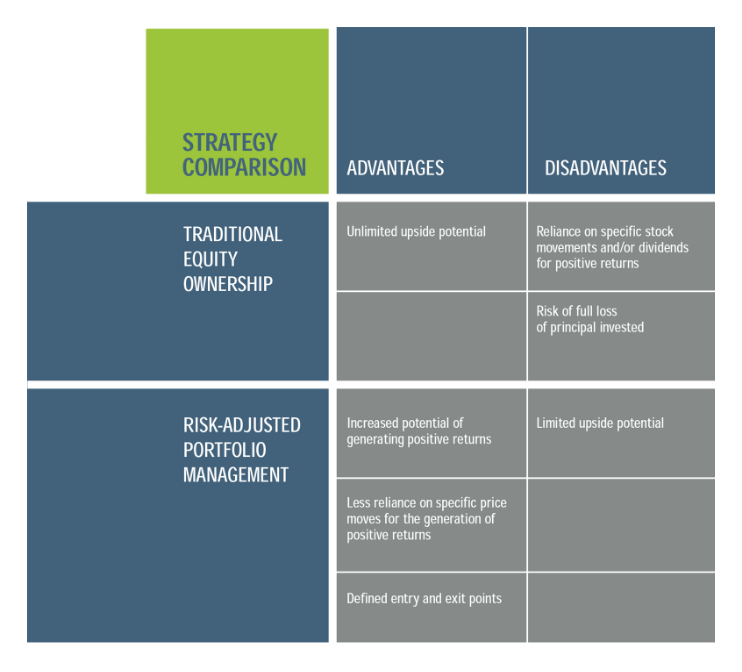

Strategy Comparison

Risk Adjusted vs. Traditional Ownership

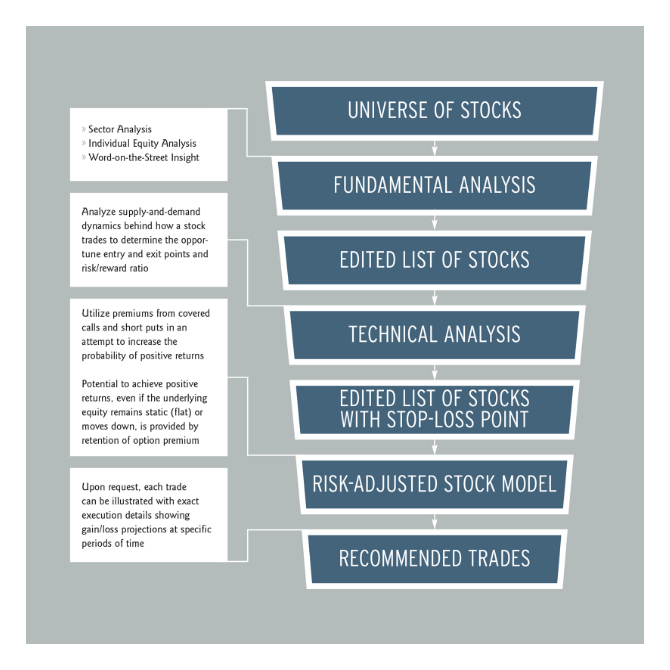

Stock Selection